The Future of Banking

for E-commerce

Bee the financial institution that reduces customer acquisition

cost up to 10x and enhance user engagement up to 5x.

The Growing

E-commerce Landscape

The e-commerce sector is witnessing exponential growth, presenting a vital opportunity for banks to leverage and expand their digital footprint.

Neo and Challenger banks have recognized this and are focusing their efforts online.

Collaboration with fintechs enhances digital banking by offering comprehensive services, including expanded credit lines and versatile virtual credit card solutions, essential for capturing the e-commerce market's growth.

The Missing Piece of the Puzzle

To capitalize on the growing e-commerce landscape a comprehensive platform that connects your bank with an extensive network of merchants, enabling instant credit and seamless payments, is needed.

Introducing beez

Beez is a plug-and-play, white label shopping app for financial institutions.

From Browsing to Checkout, Beez transforms the shopping experience with its intuitive interface, offering instant credit at the point of sale and making online purchases smoother than ever.

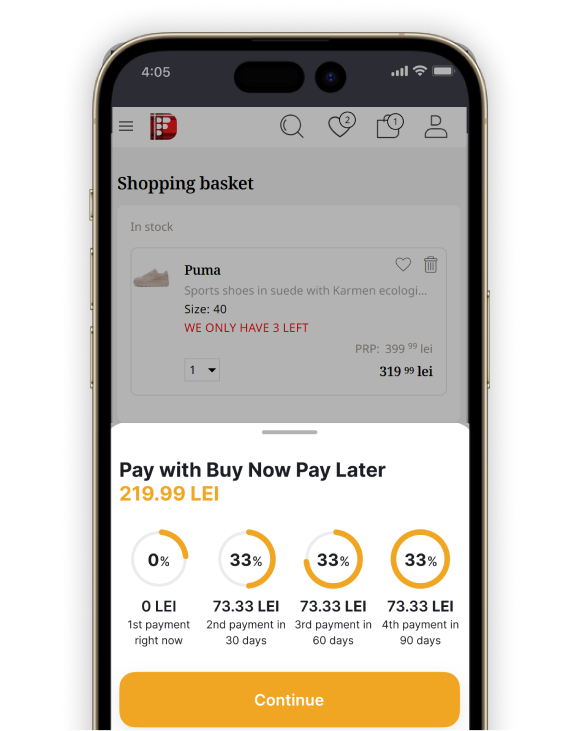

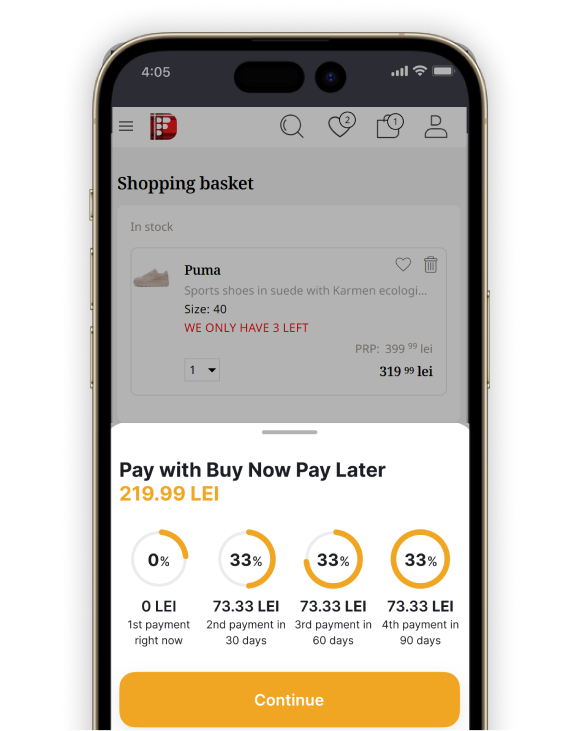

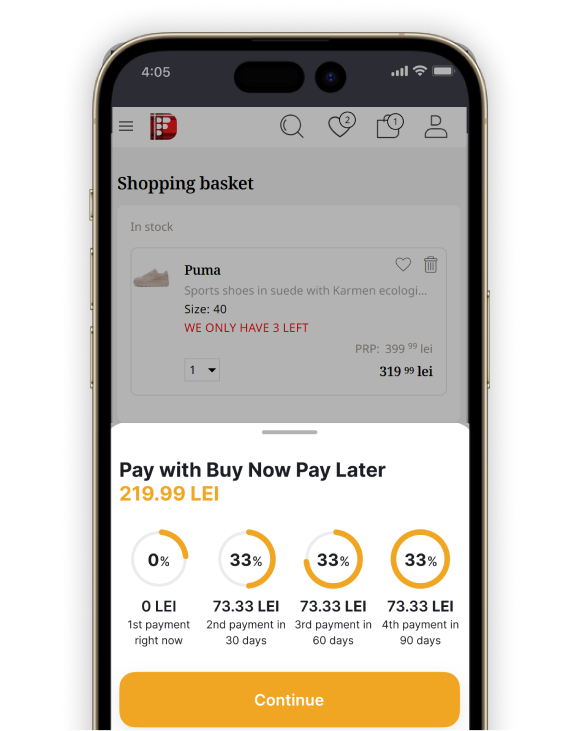

After the product it in the shopping cart of the merchant, the user will be prompted to split the payment

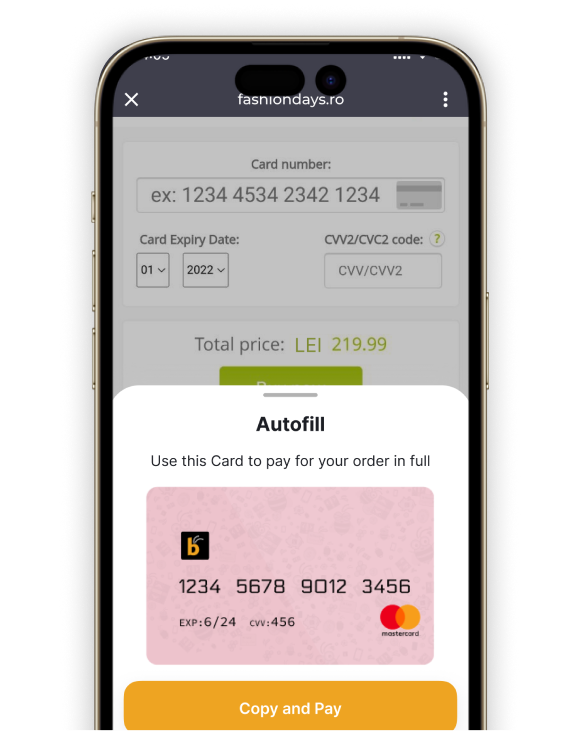

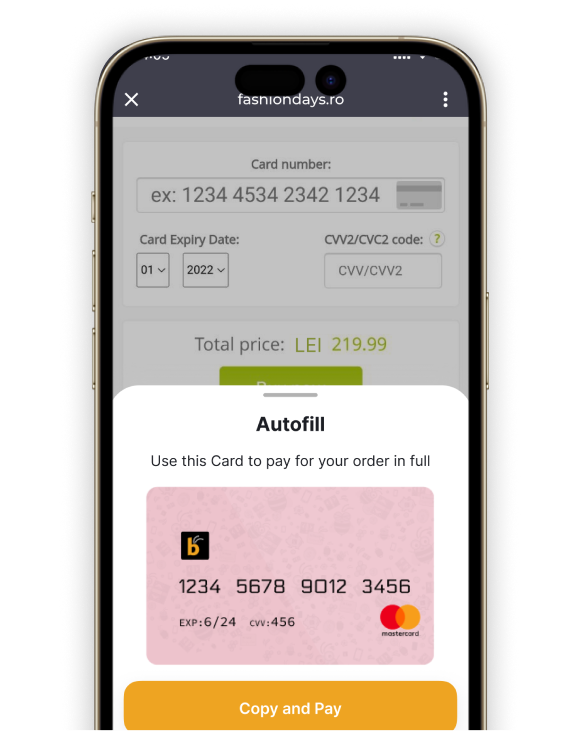

We're issuing on the spot a one time virtual card that the user can use to pay in full to the merchant for a seamless payment experience

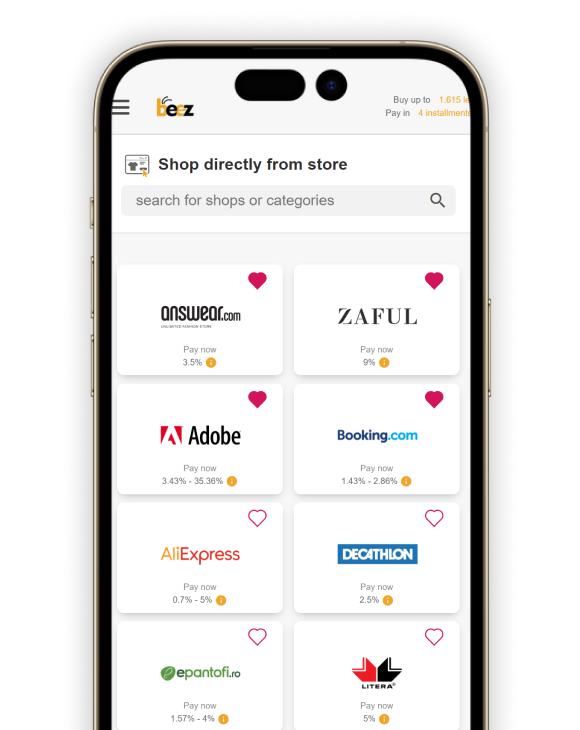

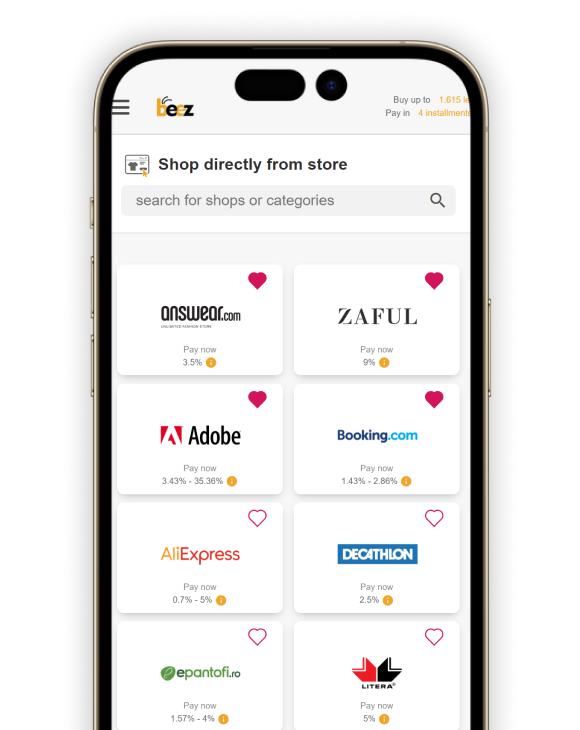

In the shopping tab, customers can see a list of merchants, that we add to the app, which they can access via our in-app browser

After the product it in the shopping cart of the merchant, the user will be prompted to split the payment

We're issuing on the spot a one time virtual card that the user can use to pay in full to the merchant for a seamless payment experience

In the shopping tab, customers can see a list of merchants, that we add to the app, which they can access via our in-app browser

After the product it in the shopping cart of the merchant, the user will be prompted to split the payment

Already beezing with

TBI Bank is an online and offline lending institution that offers customers in Romania access to a wide range of financing products and digital banking solutions, such as online and in-store loans, credit cards, loans, insurance, etc.

Tbi Bank plans to develop a strong B2C presence and BNPL is one of the main drivers to acquire and retain new customers.

Beez Integration

The Process

Our solution is designed to be simple and efficient to integrate, causing

minimal disruption to your existing banking operations.

With our plug-and-play setup, we can seamlessly become a part of

your existing digital banking flows.